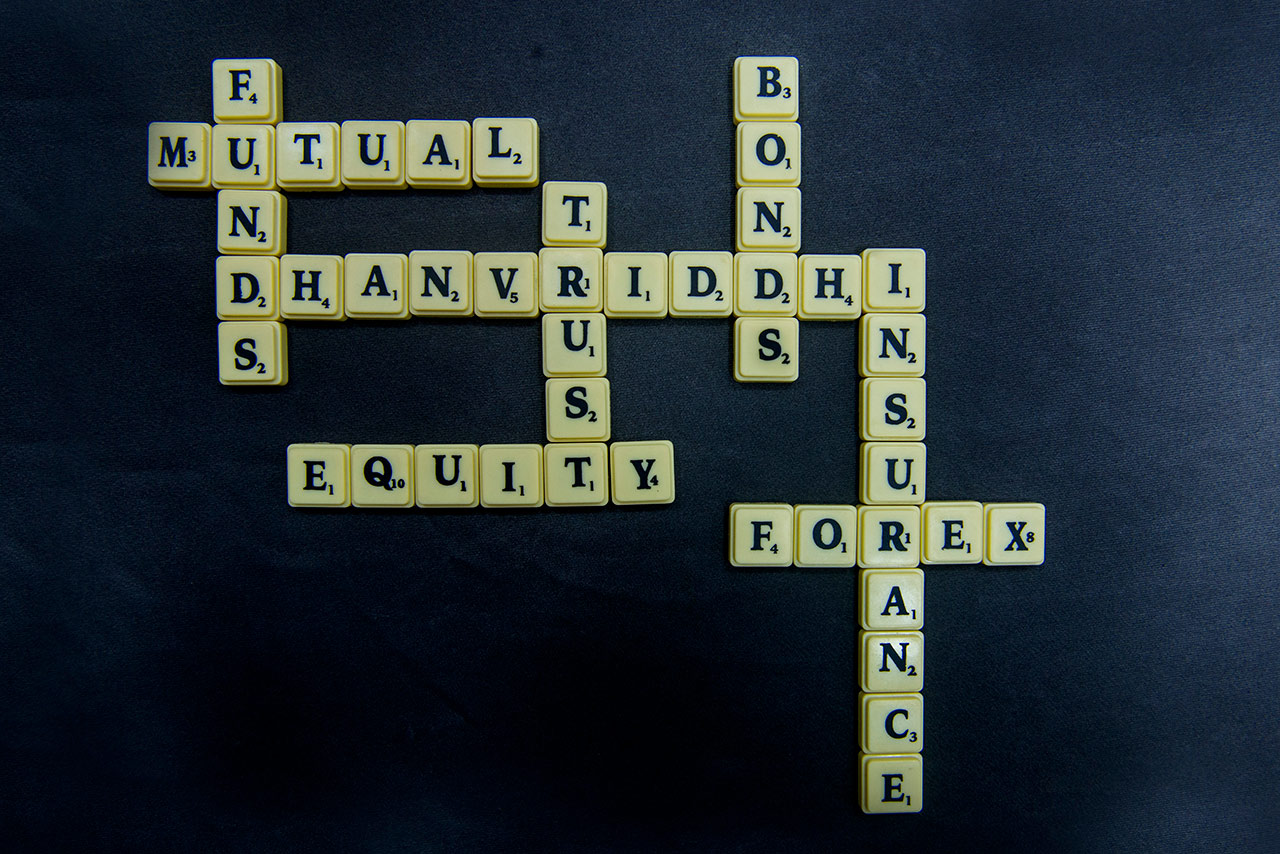

Dhanvriddhi Finvest offers valuable services in financial investment, Insurance and our finance management related service.

Investing

Investment helps us to keep funds ready for planned life needs.

Insuring

Insurance Solutions enable individuals to protect what they value.

Other Services

Other finance management services from Dhanvriddhi Finvest.

Don’t Miss

Your Financial planning may not be complete without these plans

- Medi-SIP

- Guaranteed Millionaire

- Life Time Pension

- Unique Child Gift

- Mutual Funds for Life Journey

“That economics is untrue which ignores or disregards moral values.”

ENDURANCE

INTEGRITY

EMPATHY

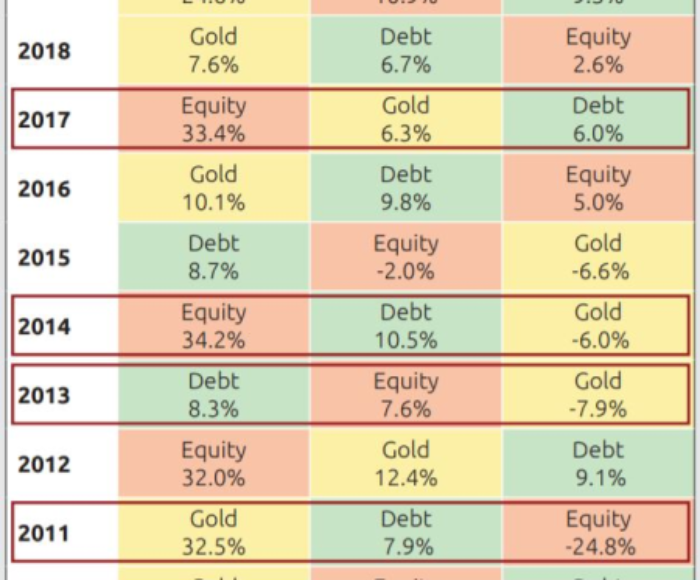

Financial advising is an accountable job and we understand it to its core. Our experience has made our job easy a bit because the market ups & downs have really taught us how & what to do in such situations.

Our values keep us focus on our job which helps us delivering consistent results. Our simple mantra is:

Start small but start early and be consistent while investing.

We work with change-oriented individuals to help them make better decisions, convert those decisions to actions.

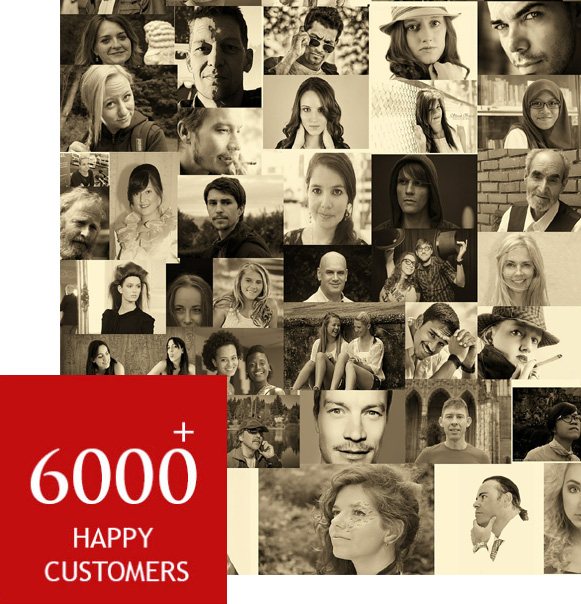

We have served more than 6,000 Clients with our spot-on advice on future investments. The money our investors parked ten years back has yielded them expected results.

Serving the industry for the last 20 years which has made us learn great lessons about how to act when the market is shaky versus when the market is rocking.

Investment is a journey which we share with our investors. We have been very open with our investors to share the risks involved in any investments to avoid any confusion.

stay connected with us

We work with you to address your most critical investment priorities

We have continued to be innovators for our industry, with an entrepreneurial culture that is never satisfied with the status quo, for ourselves or for our clients.

Proprietary data, expert analysis and provocative points of view for leaders seeking sustained, profitable growth.